All your financial admin. Done.

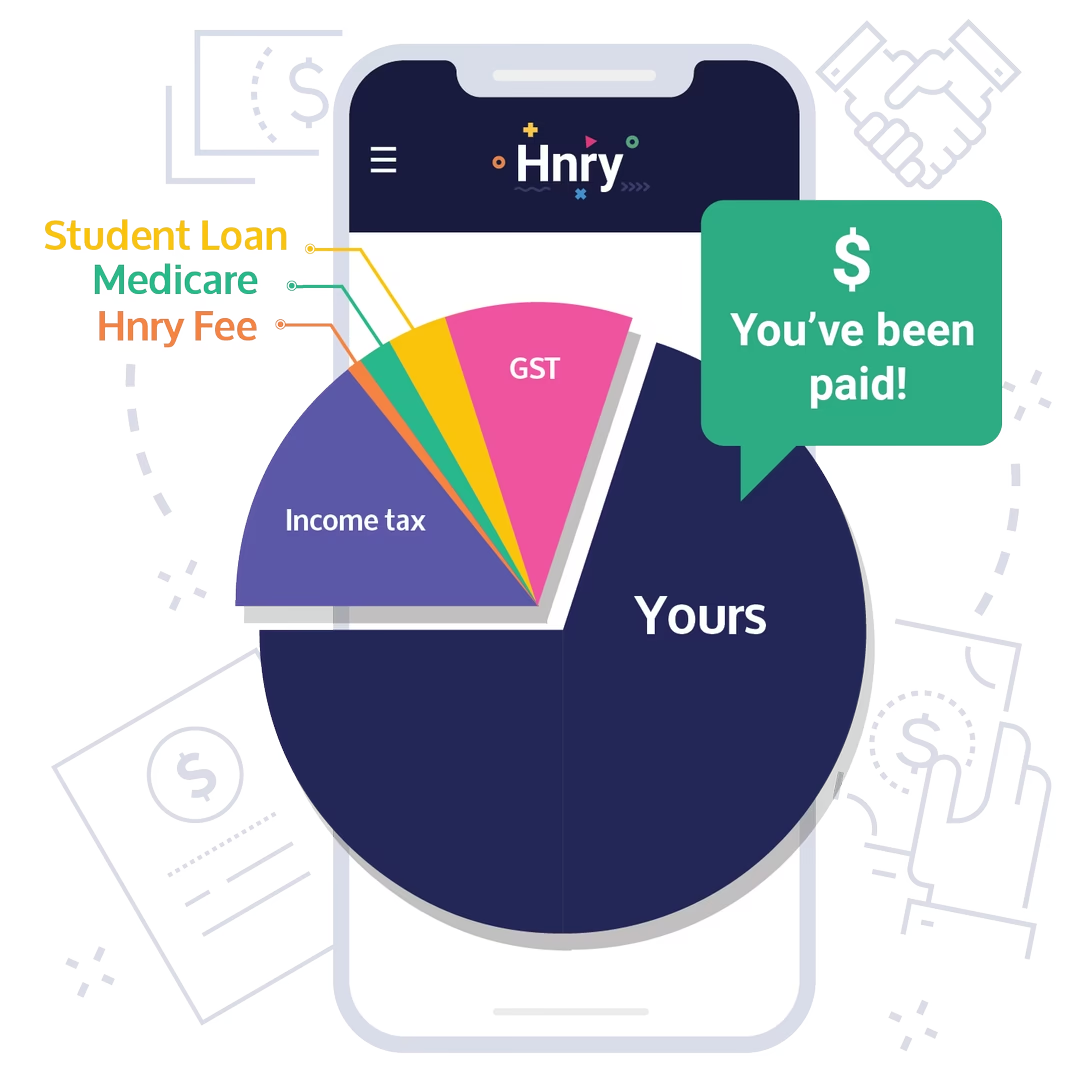

- All your taxes calculated and paid as you go.

- All your income tax & GST returns lodged by Hnry's accountants whenever they’re due.

- Unlimited expense claims managed by Hnry's team of accountants.

- Clients can pay by credit card at no extra cost to you.

- Unlimited support from our team of local expert accountants.